ECON 0150 | Economic Data Analysis

The economist’s data analysis stillset.

Part 4.1 | Numerical Predictors

GLM: bivariate data

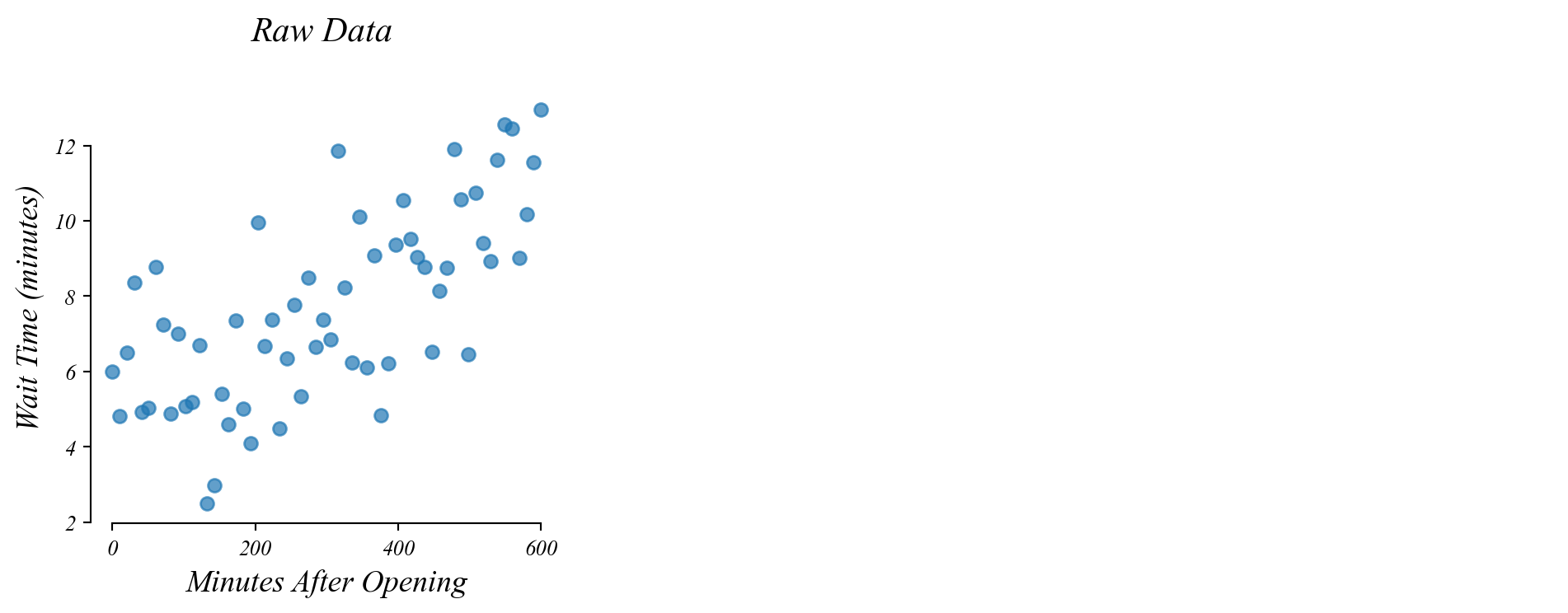

Do people wait longer later in the day?

GLM: bivariate data

Do people wait longer later in the day?

> but in general we don’t ask many questions about vertical incercepts

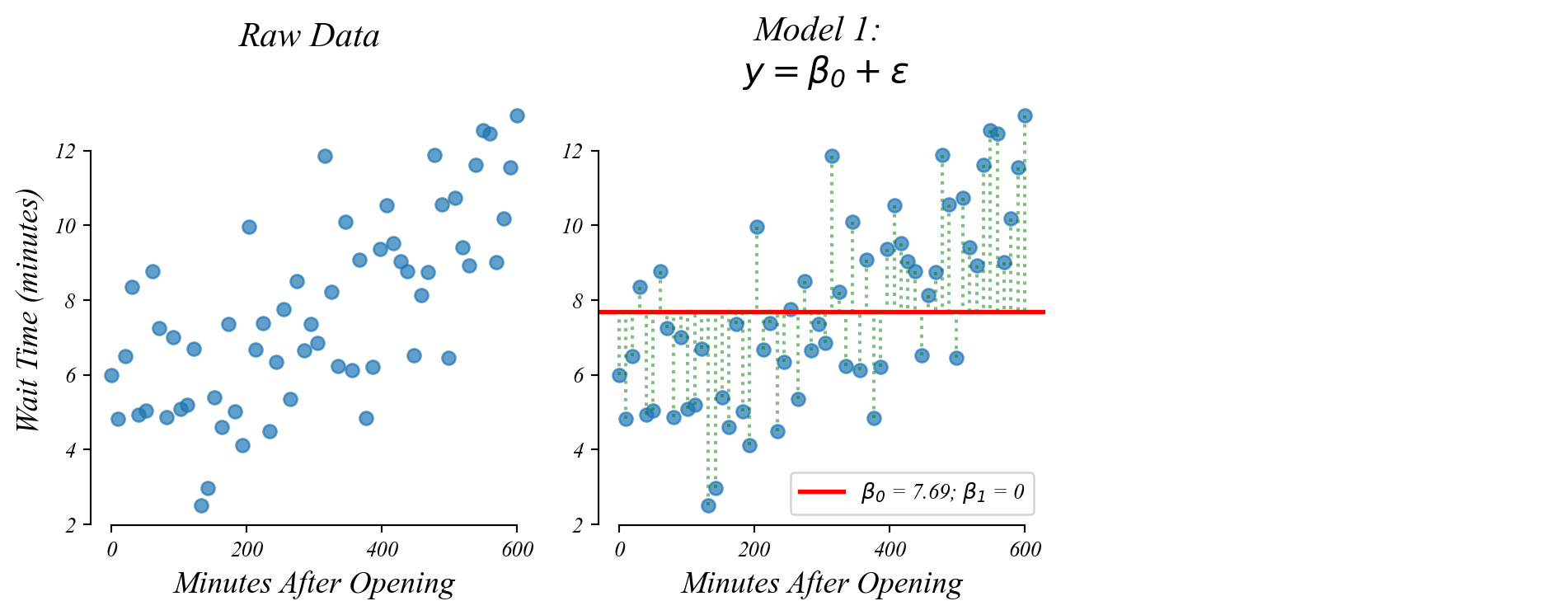

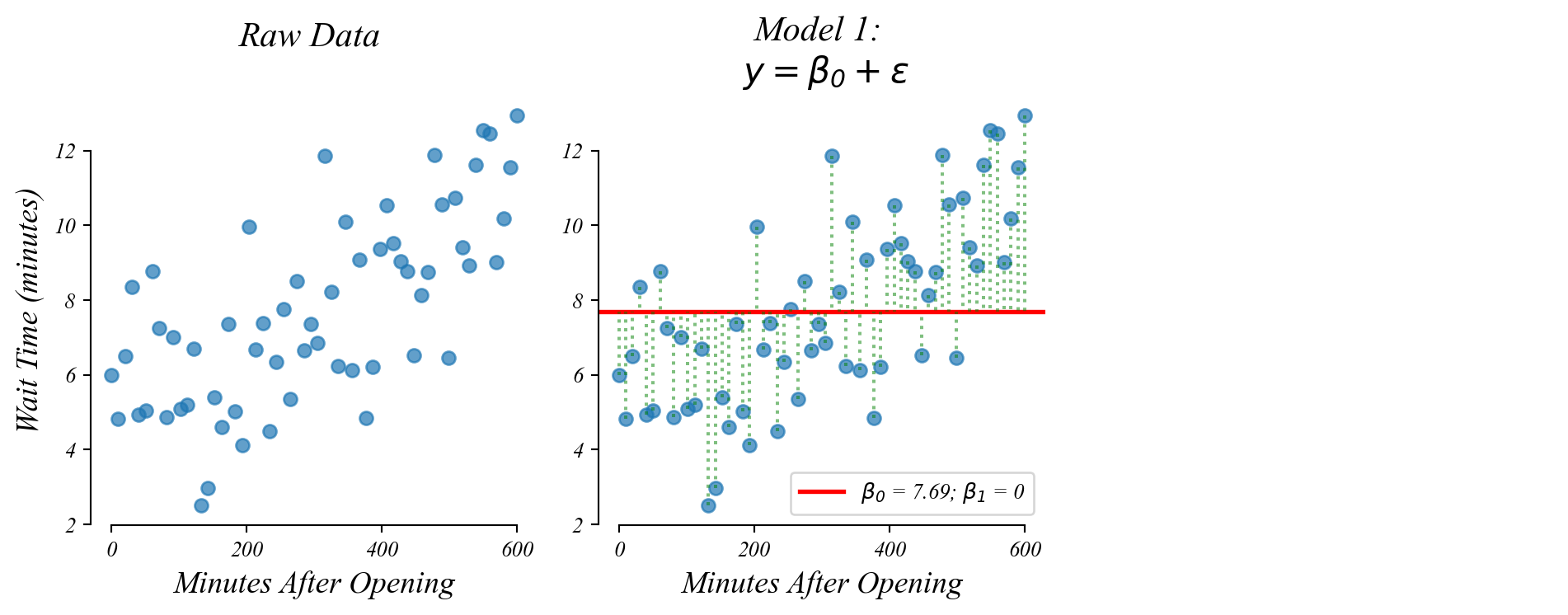

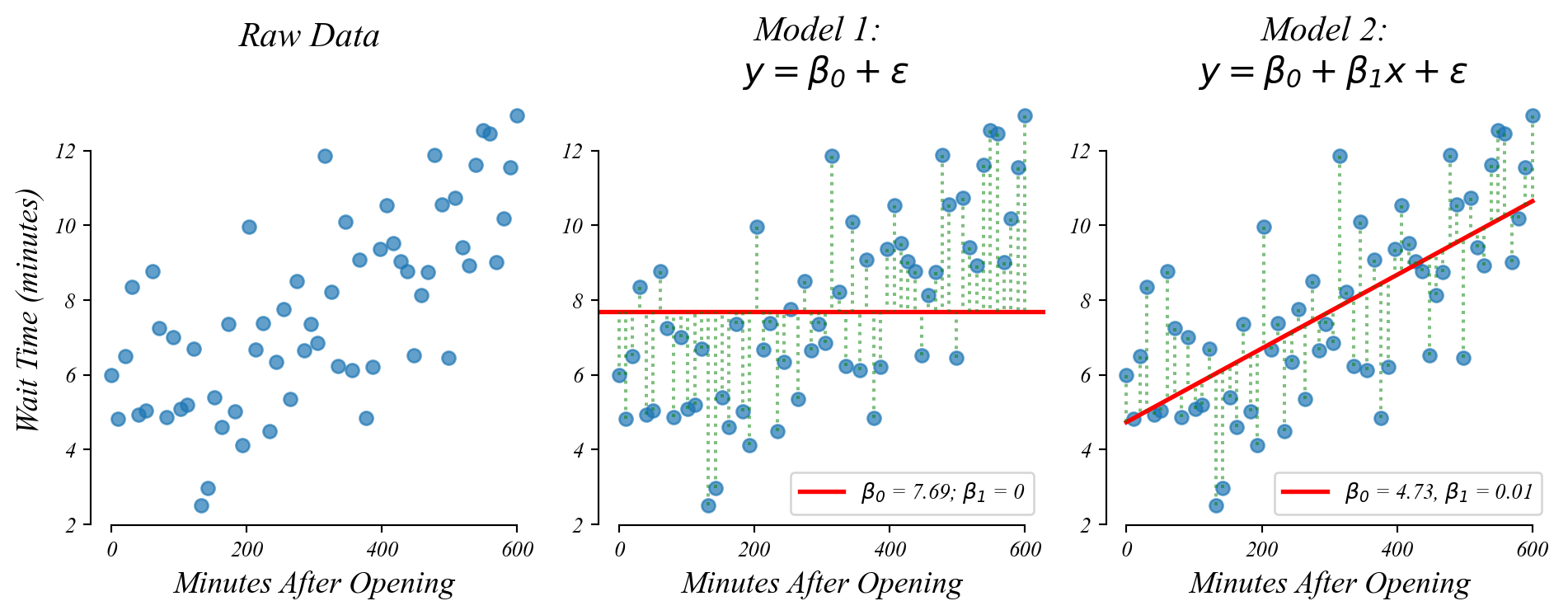

GLM: bivariate data

Do people wait longer later in the day?

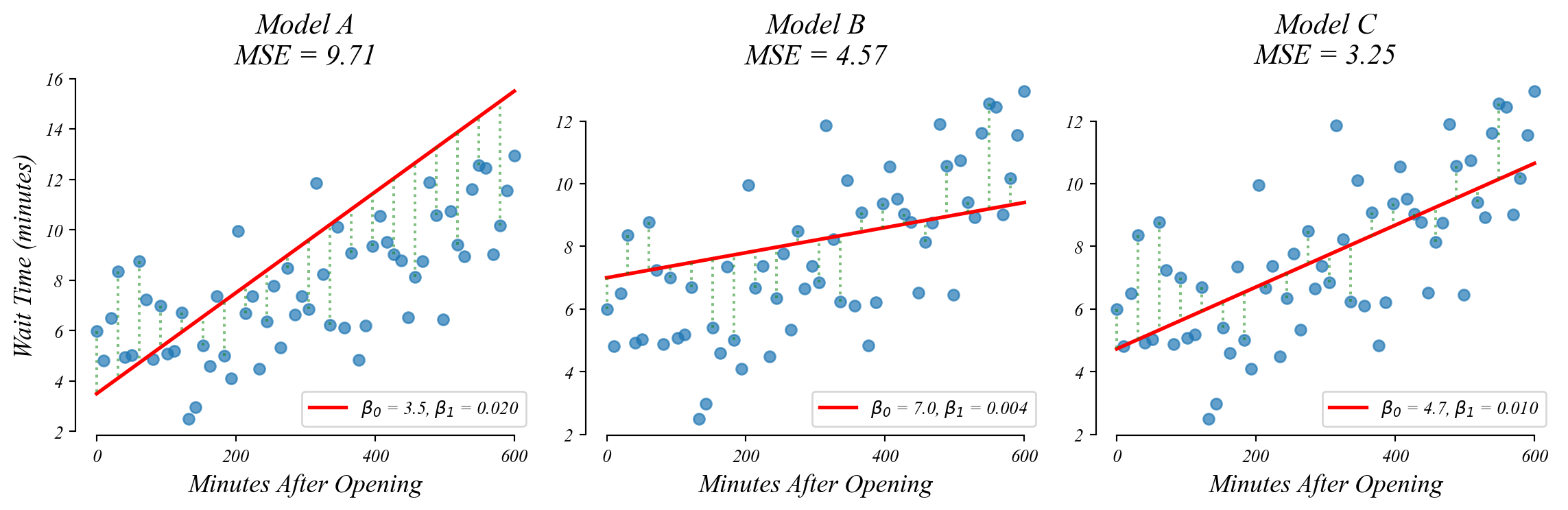

Lets compare two models.

- Model 1 (Intercept Only): \(y = b\)

- Model 2 (Intercept+Slope): \(y = mx + b\)

GLM: bivariate data

Do people wait longer later in the day?

> a slope (β₁) improves model fit (MSE; ‘wrongness’) when there’s a relationship

> the intercept is no longer the mean

Bivariate GLM: minimizing MSE

Which model minimizes the models’ ‘wrongness’ (Mean Squared Error)?

> Model C minimizes MSE!

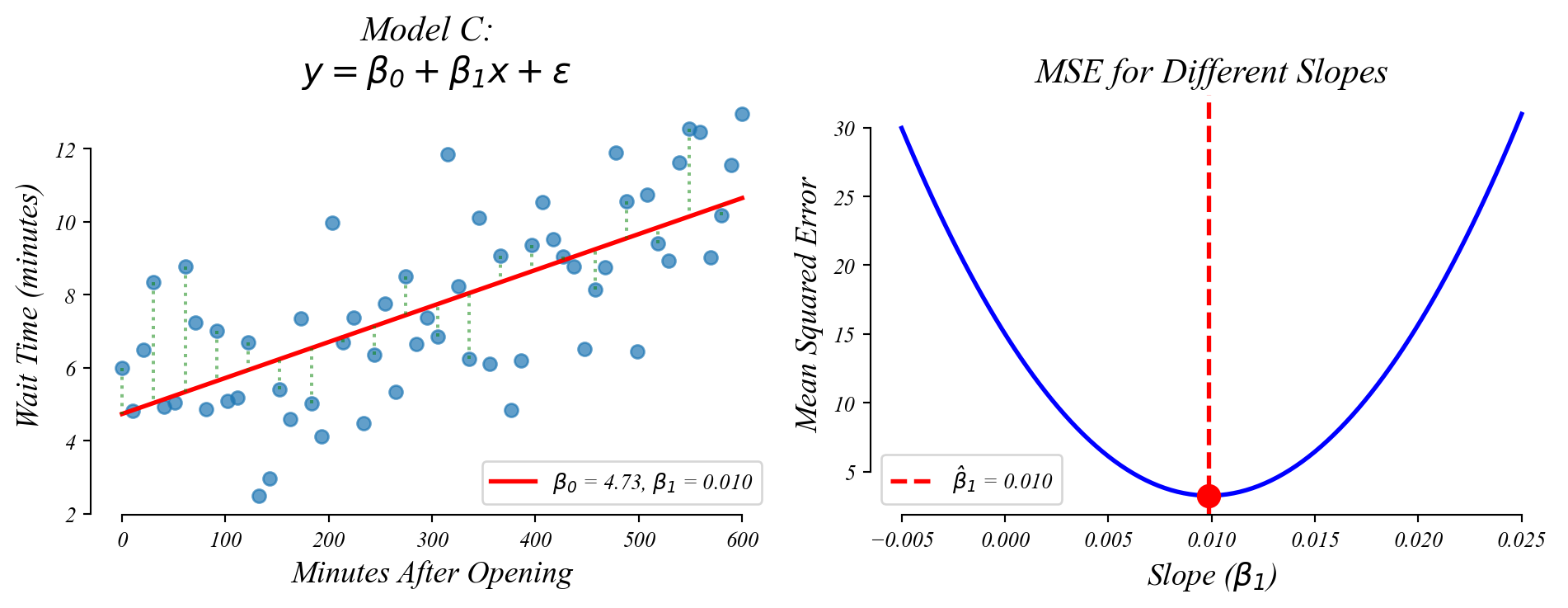

Bivariate GLM: minimizing MSE

GLM selects the \(\beta_1\) with the smallest MSE.

> this slope (β₁) gives the best guess of the relationship between x and y

> but what if the true slope is zero … could this slope be just sampling error?

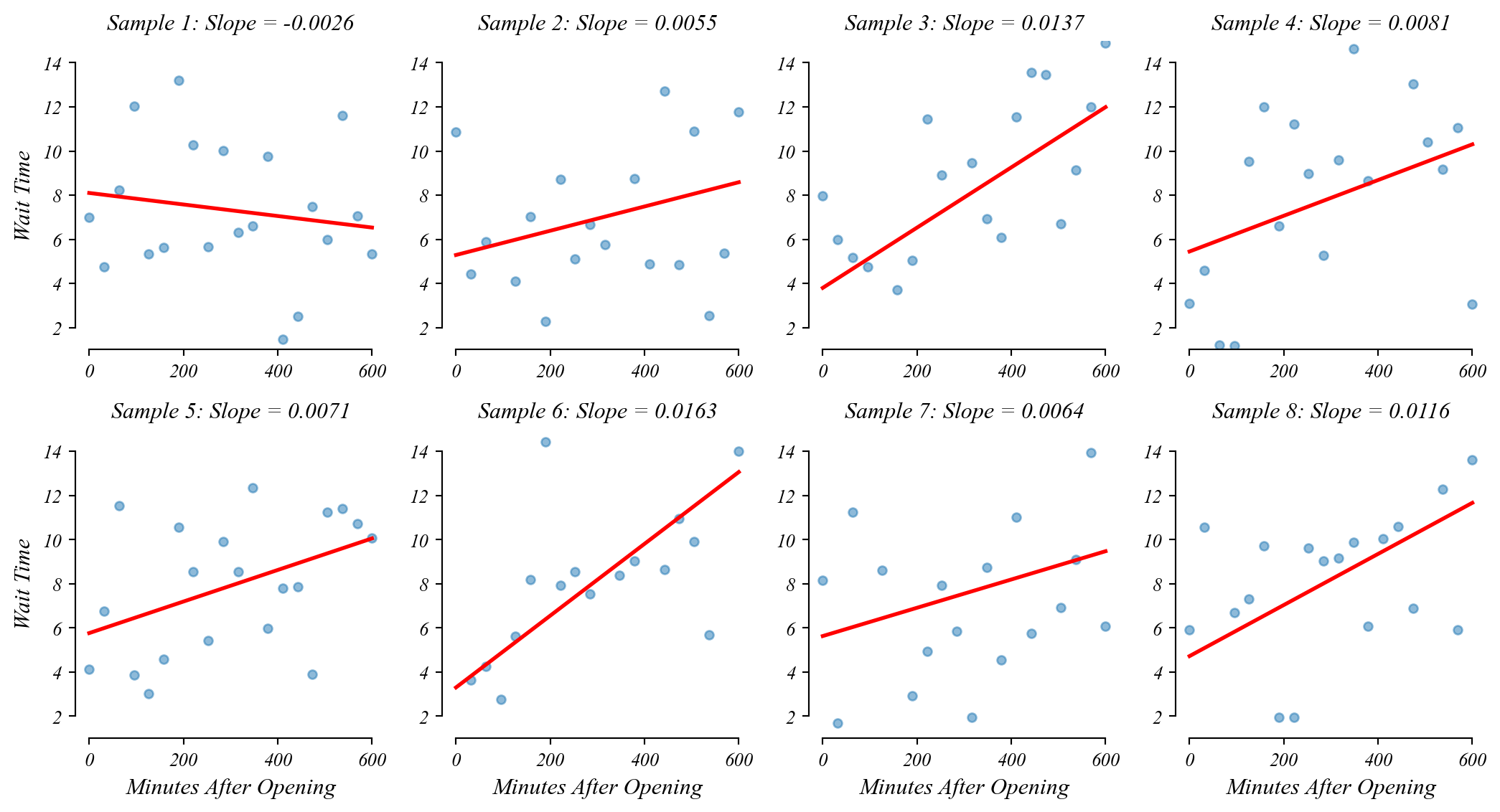

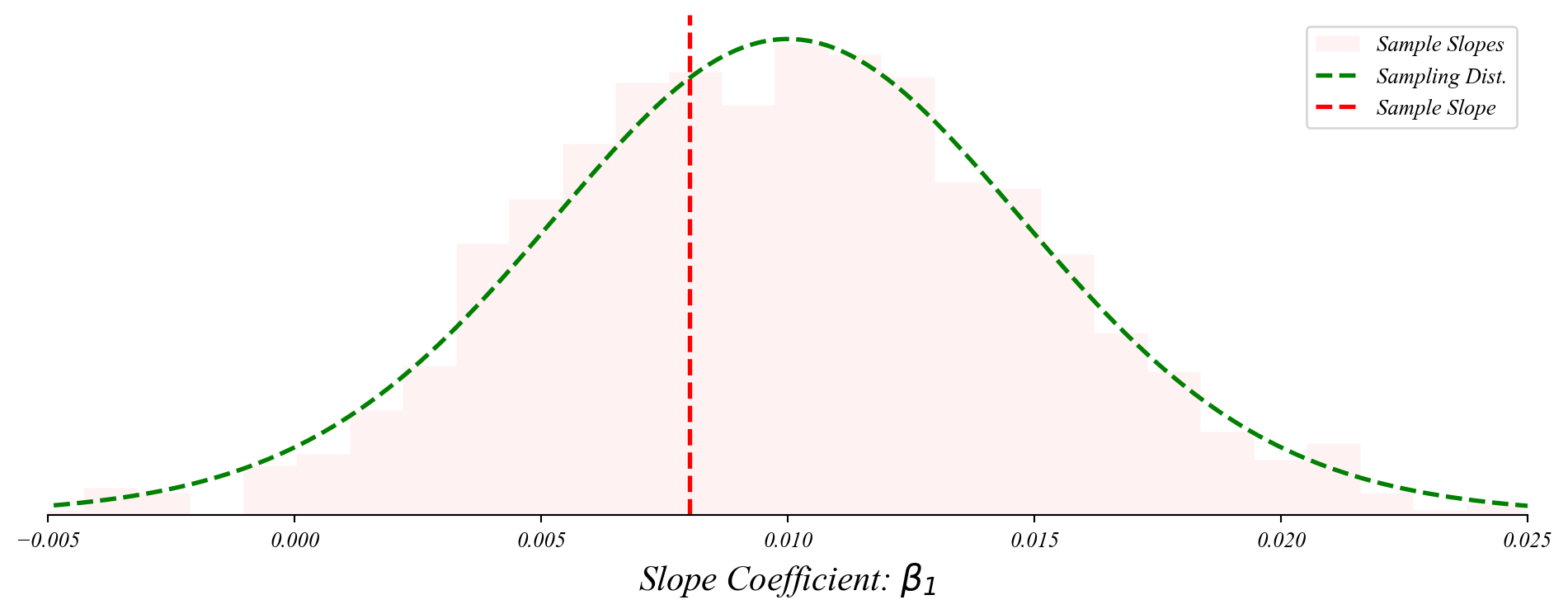

Bivariate GLM: sampling error

Like before, if we take many samples, we get slighly different slopes and slighly different fits.

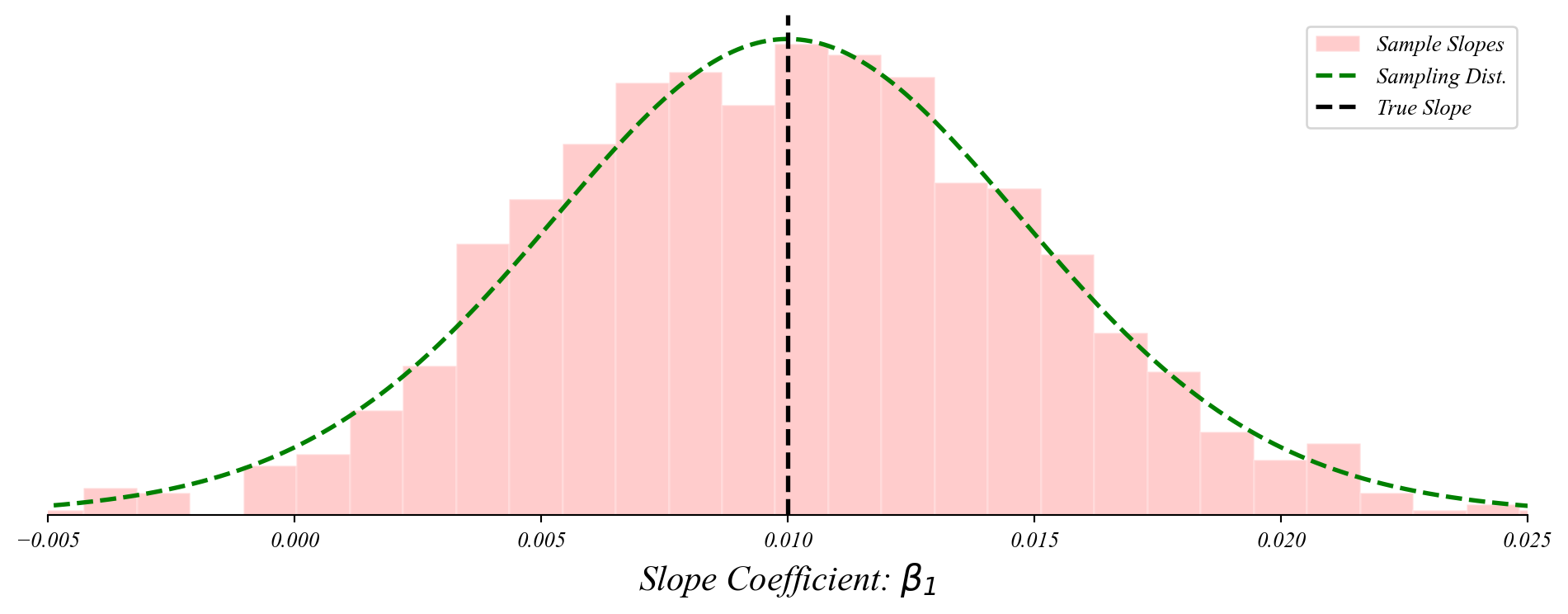

Bivariate GLM: sampling distribution of slopes

The slope coefficient follows a normal distribution centered on the population slope.

> the slopes follow a normal distribution around the population relationship!

> this lets us perform a t-test on the slope!

Bivariate GLM: sampling distribution of slopes

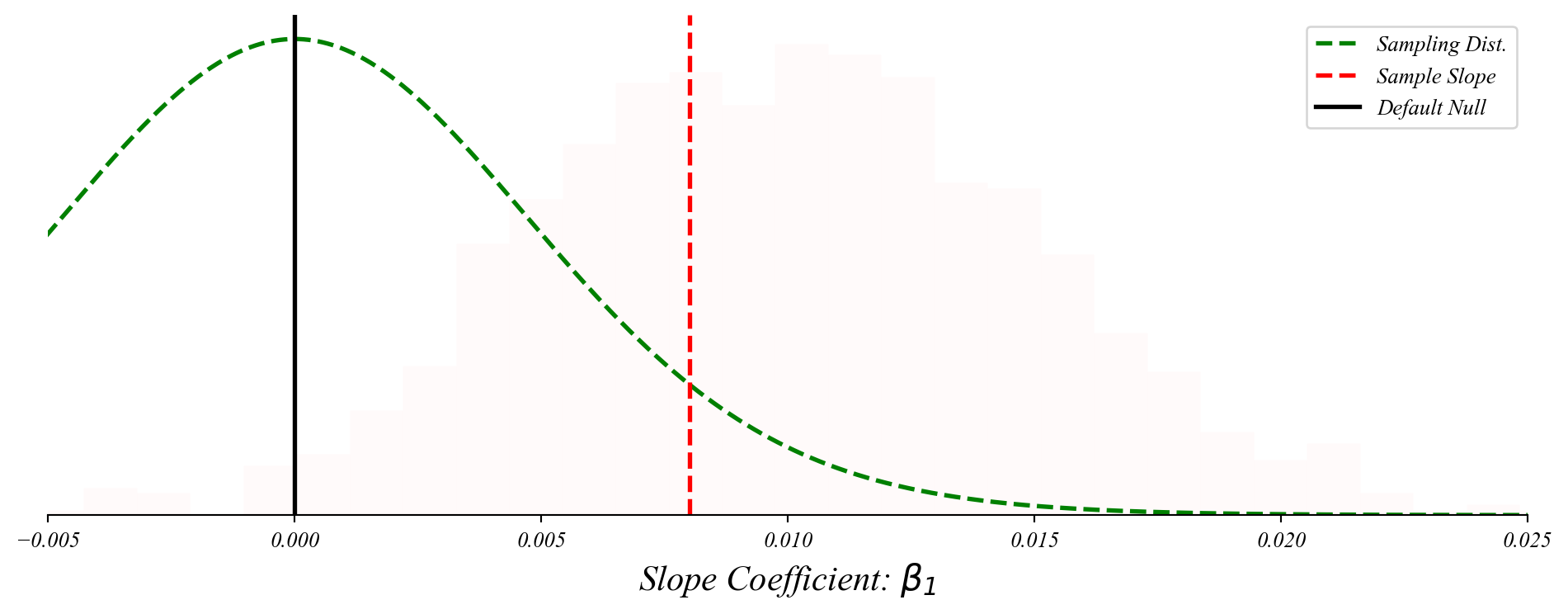

The slope coefficient follows a normal distribution centered on the population slope.

> we don’t know the entire distribution, just our sample slope

Bivariate GLM: sampling distribution of slopes

The slope coefficient follows a normal distribution centered on the population slope.

> center the distribution on our null

> check the distance from the sample

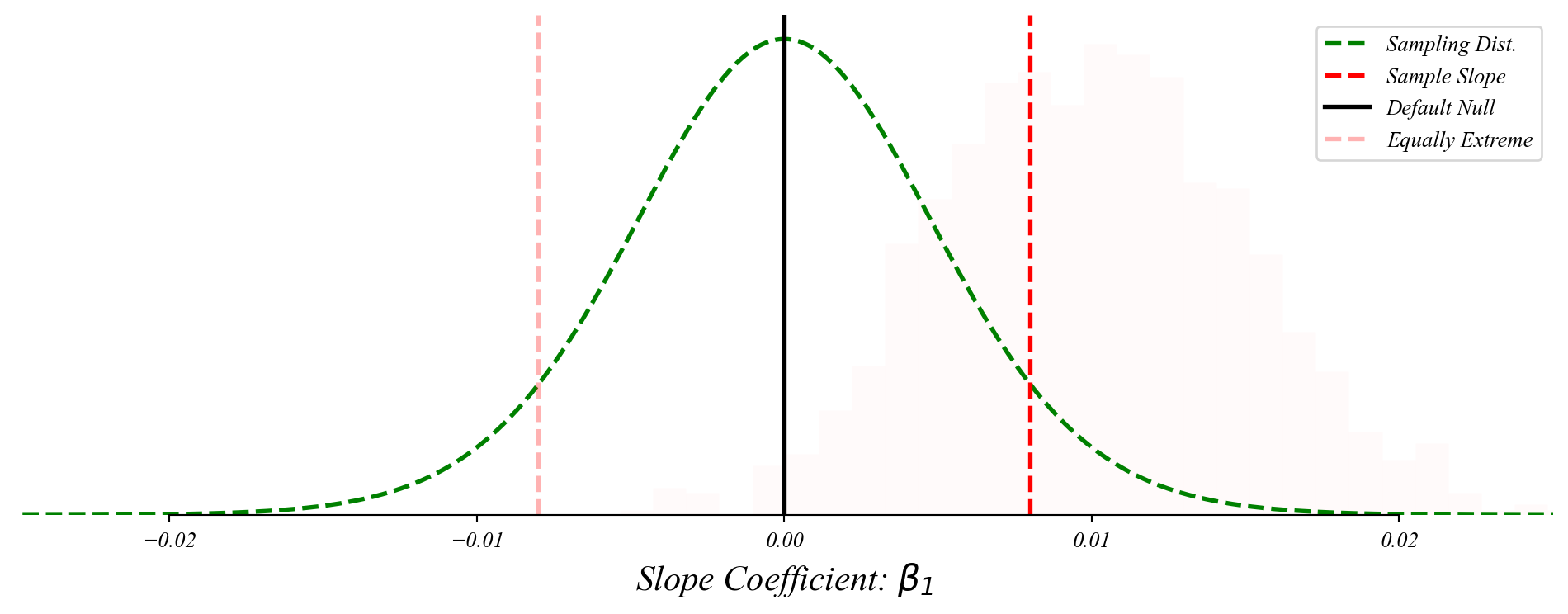

Bivariate GLM: sampling distribution of slopes

The slope coefficient follows a normal distribution centered on the population slope.

> the p-value is the probability of something as far from the null as our sample

Bivariate GLM: sampling distribution of slopes

The slope coefficient follows a normal distribution centered on the population slope.

> p-value: the ‘surprisingness’ of our sample if \(\beta_1 = 0\)

> the probability of seeing our sample by chance if there is no relationship

> a small p-value is evidence against the null hypothesis (\(\beta_1 = 0\))

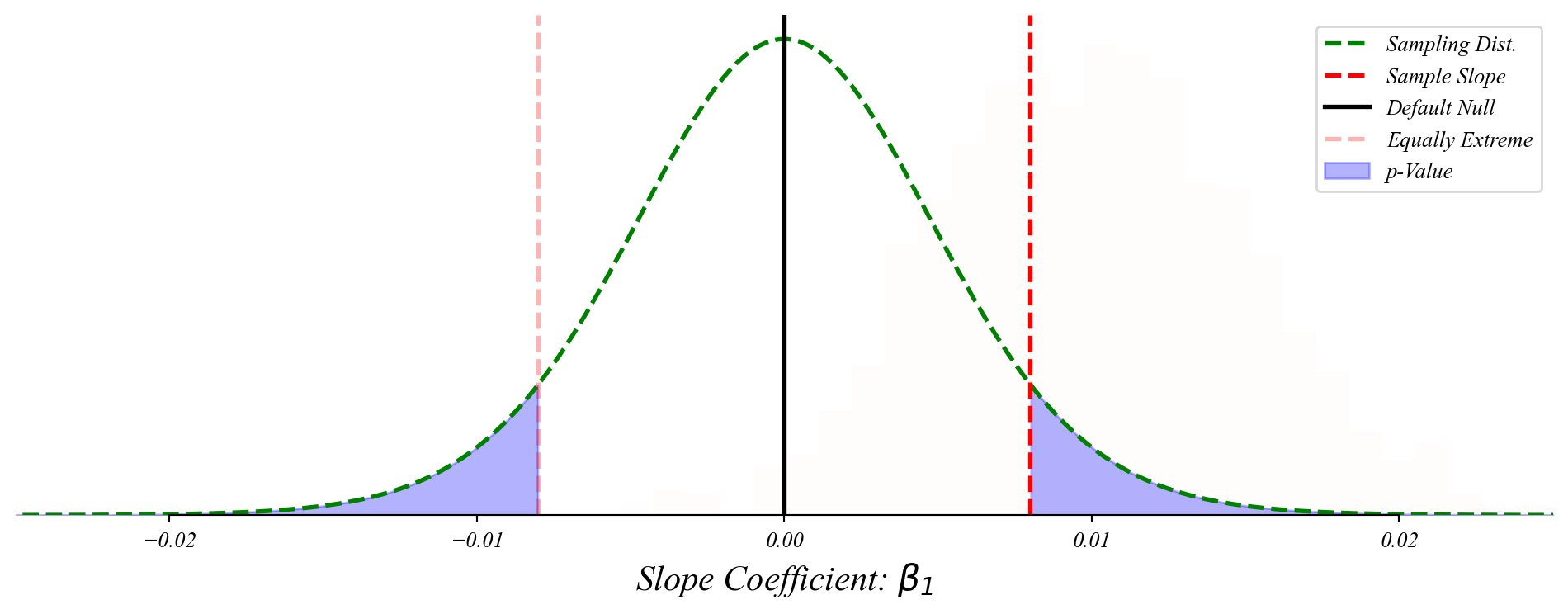

Bivariate GLM: sampling distribution of slopes

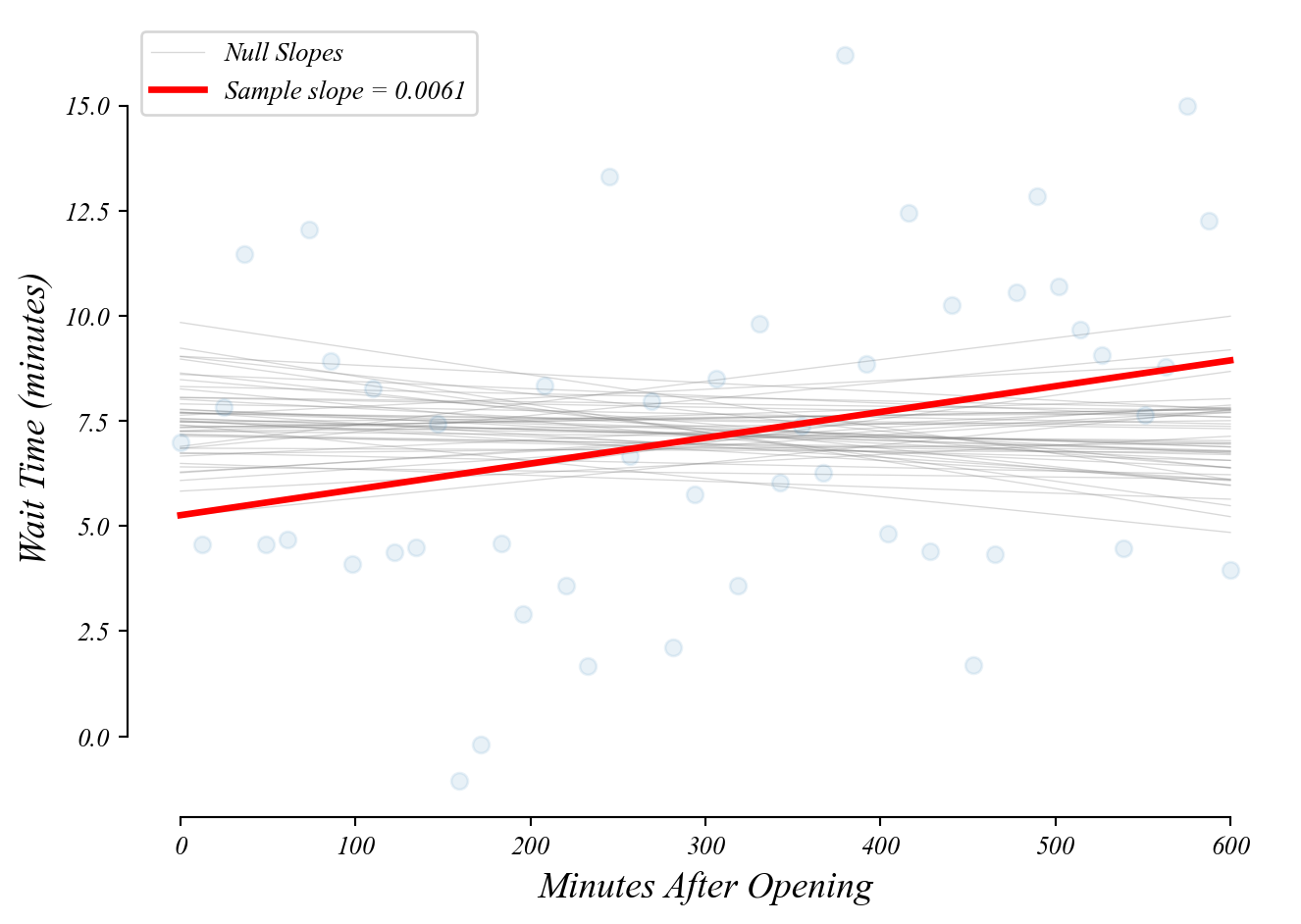

Many possible models we might observe by chance if the null (\(\beta_1 = 0\)) were true.

> how likely does it look like this slope was drawn from the null slopes?

> p-value: the probability a slope as extreme as ours under the null (\(\beta_1=0\))

Exercise 4.1 | Happiness and Per Capita GDP

Are wealtheir countries happier?

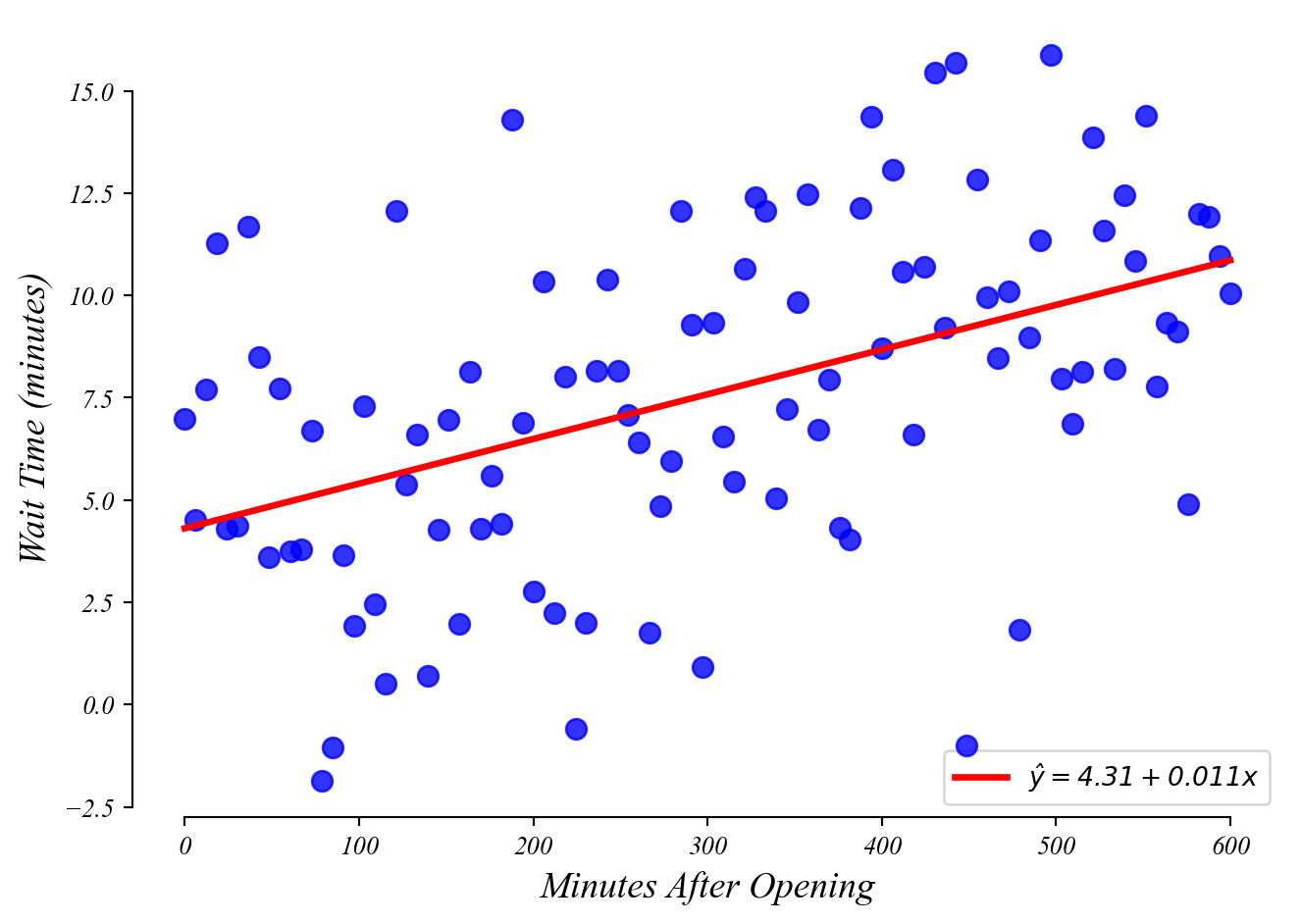

GLM: predictions

What wait time should we expect at 100 minutes after open?

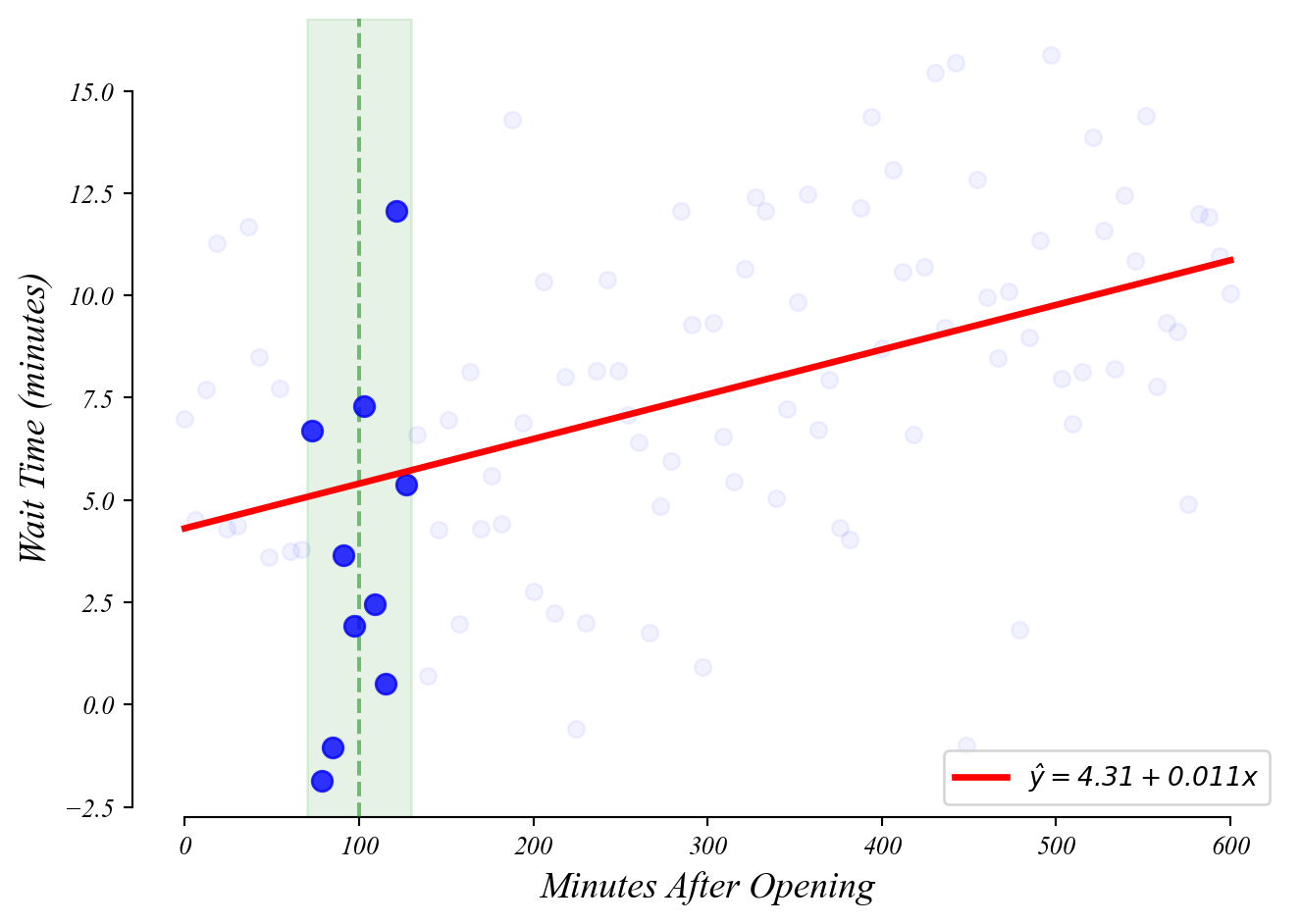

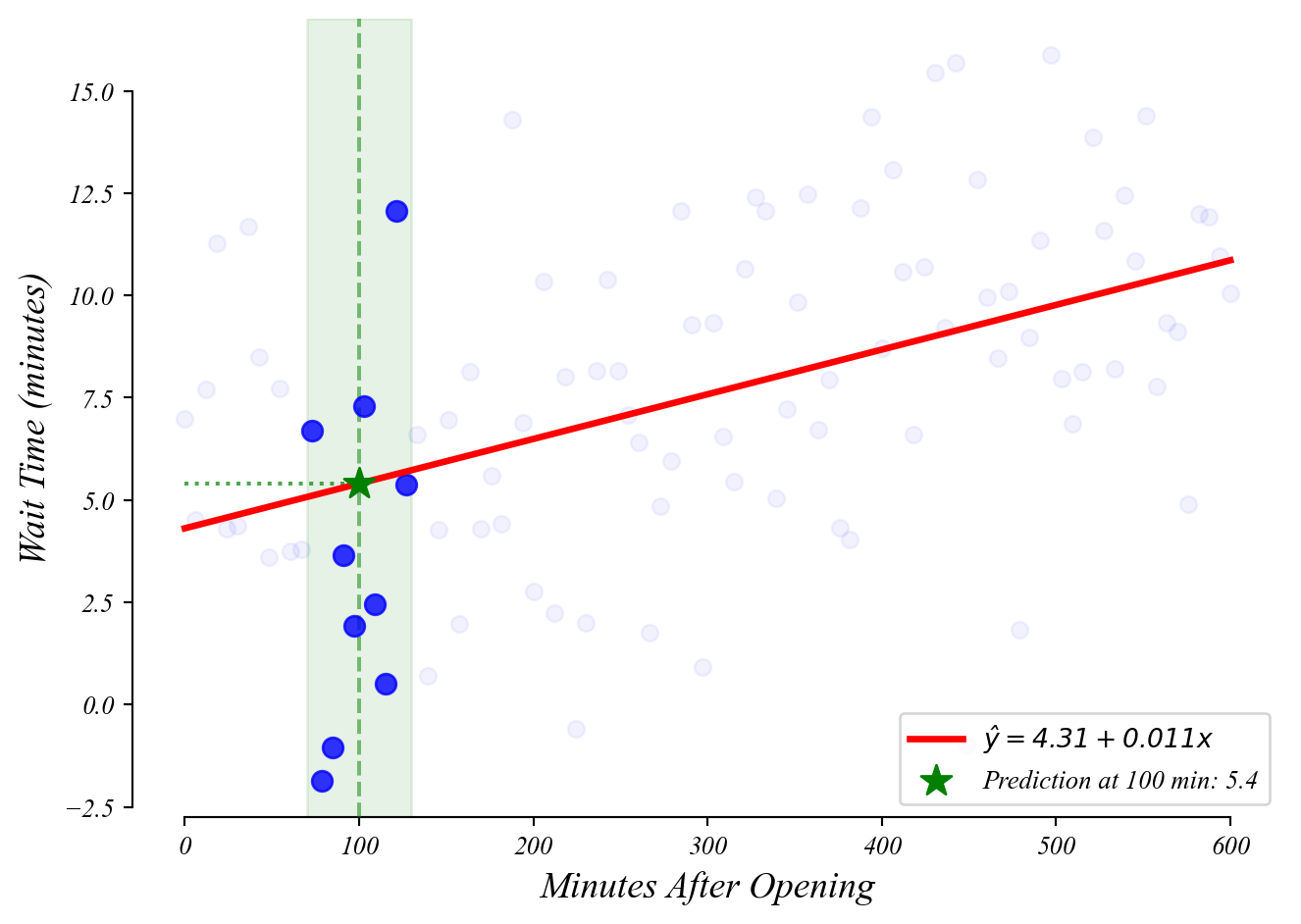

GLM: predictions

What wait time should we expect at 100 minutes after open?

GLM: predictions

What wait time should we expect at 100 minutes after open?

> you can find this with a calculator!

> plug \(x=100\) into the equation \(y = 4.31 + 0.011 x\)

GLM: predictions

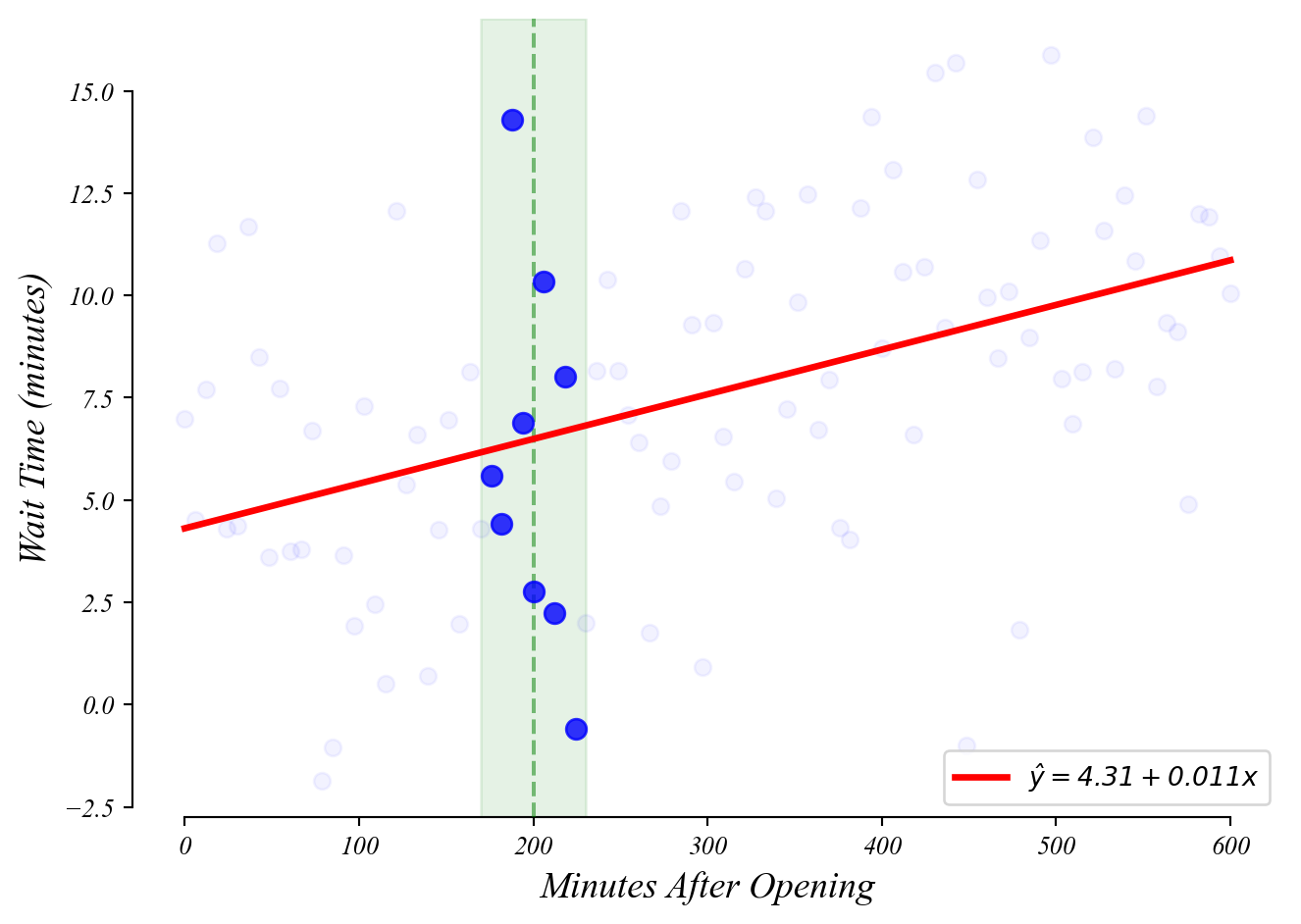

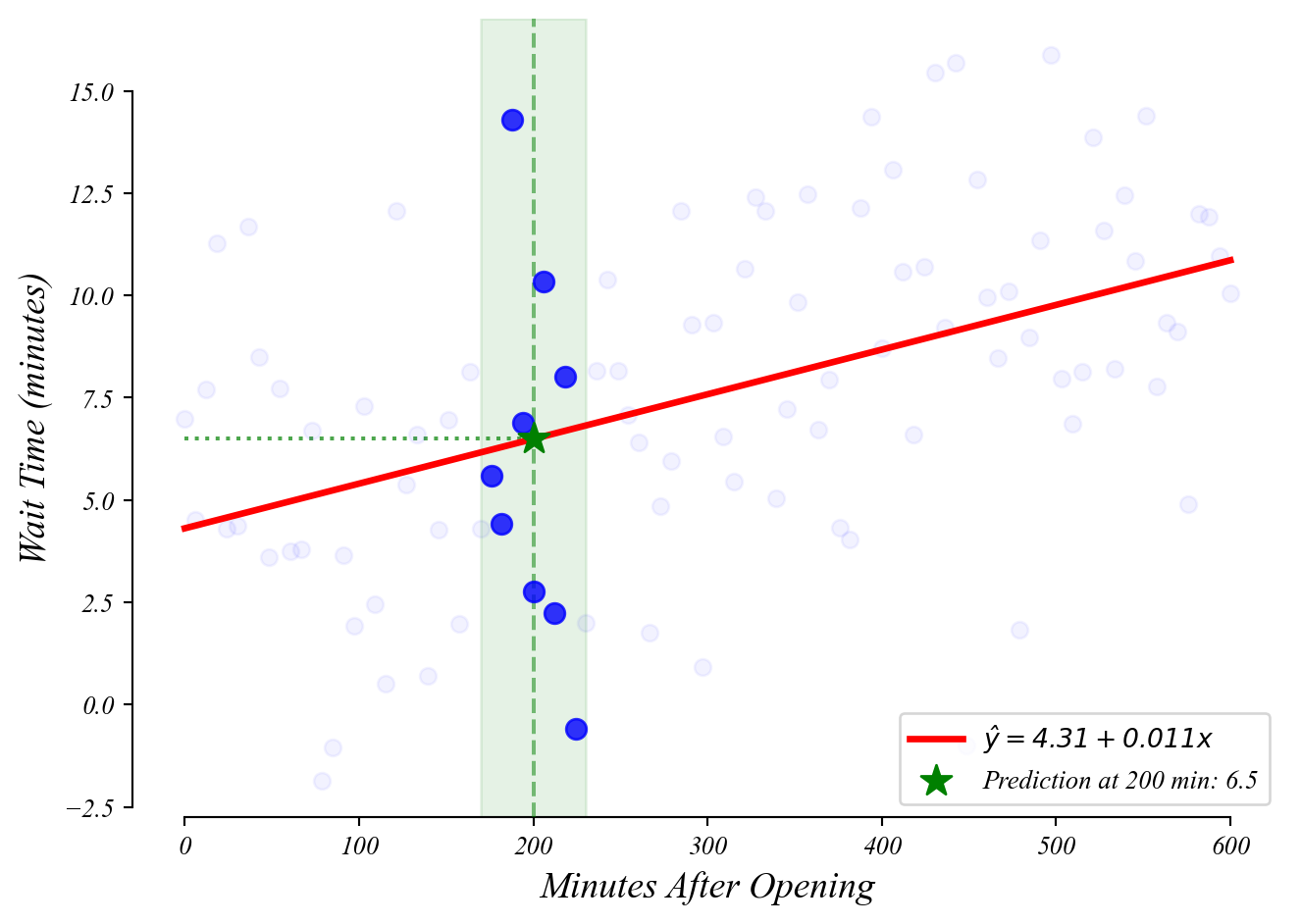

What wait time should we expect at 200 minutes after open?

GLM: predictions

What wait time should we expect at 200 minutes after open?

Exercise 4.1 | Happiness and Per Capita GDP

Are wealtheir countries happier?

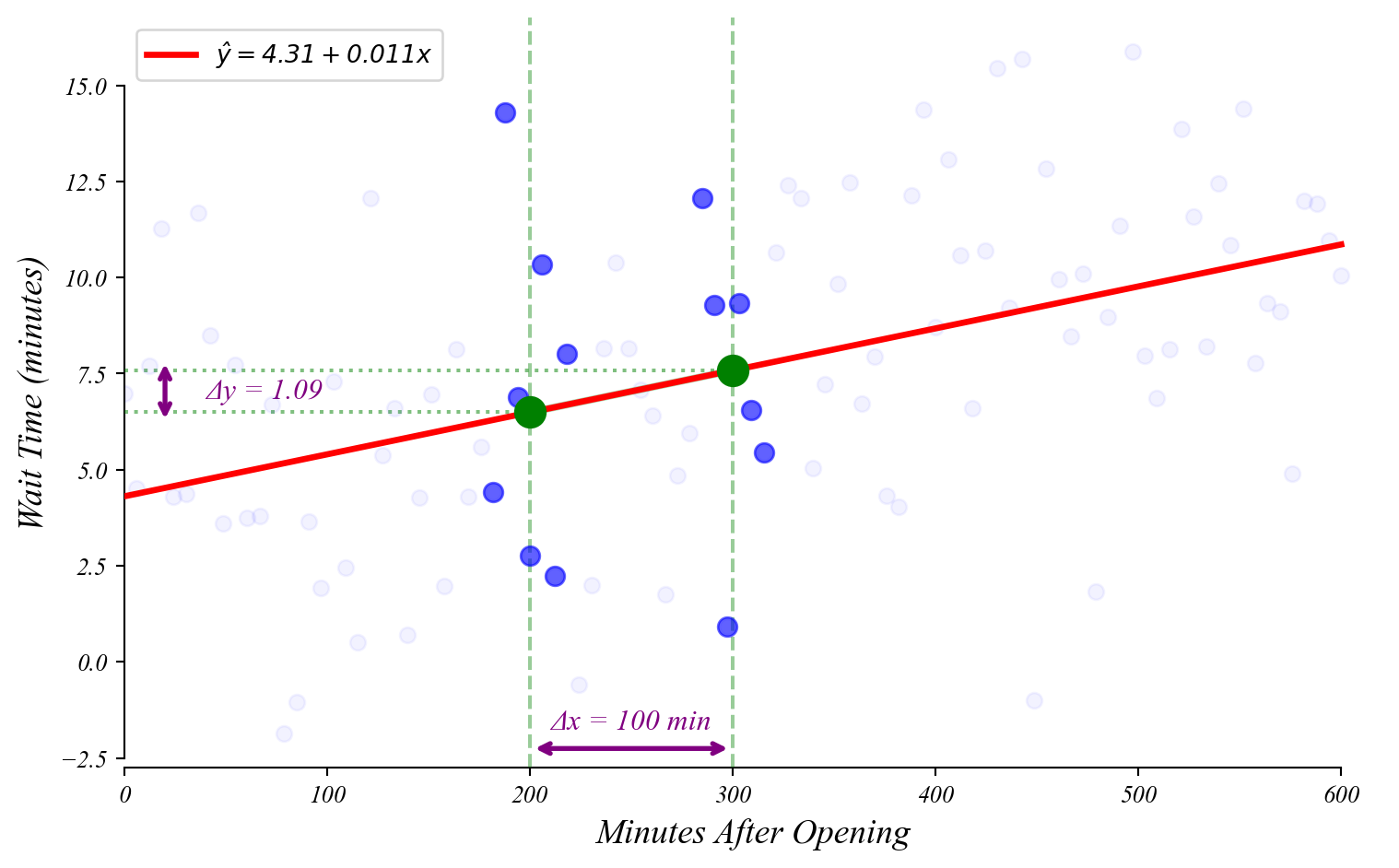

GLM: interpretation

How much does wait time increase every minute after open?

> \(\beta_1\) tells us how much \(y\) increases with every 1 unit increase in \(x\)

Exercise 4.1 | Happiness and Per Capita GDP

How much does happiness increase for each additional $1,000 of per capita GDP?

The General Linear Model

GLM performs a t-test on all model coefficients.

Univariate (Part 3): \(y = \beta_0 + \epsilon\)

- Equivalent to a one-sample t-test

- Tests whether \(\beta_0 = \mu_0\) (default null)

Numerical Predictor: \(y = \beta_0 + \beta_1 x + \epsilon\)

- \(x\) is a numerical variable (like age, income, temperature, etc.)

- Tests both intercept (\(\beta_0 = 0\)) and slope (\(\beta_1 = 0\))

- Null hypothesis on slope: no relationship between x and y (\(\beta_1 = 0\))

The General Linear Model

GLM uses the idea of a t-test with any coefficient.

Categorical Predictor (next time): \(y = \beta_0 + \beta_1 x + \epsilon\)

- \(x\) is a categorical variable (like age, income, temperature, etc.)

- Equivalent to a two-sample t-test (when \(x\) is binary)

Multivariate GLM (Part 5):

- Adds more predictor variables: \(y = \beta_0 + \beta_1 x_1 + \beta_2 x_2 + ... + \varepsilon\)

- Each coefficient has its own t-test against the null that it equals zero

Economic Applications

GLM is the workhorse statistical tool in empirical economics.

Labor Economics: relationship between education and wages.

\[\text{wage} = \beta_0 + \beta_1 \text{education} + \varepsilon\]

Policy Analysis: relationship between minimum wages and employment.

\[\text{employment} = \beta_0 + \beta_1 \text{minimum_wage} + \varepsilon\]

Political Economy: relationship between neighbor’s party and voter turnout

\[\text{voted} = \beta_0 + \beta_1 \text{neighborhood_politics} + \varepsilon\]

Bivariate GLM: Numerical Predictors

Summary

GLM Framework:

- T-tests and regression are part of the same very flexible framework.

Numerical Predictors:

- Bivariate GLM extends the t-test by allowing continuous predictors.

Same Distribution:

- Coefficient estimates follow t-distributions centered on the true population values.

Same Interpretation:

- The p-values have the same interpretation: probability of seeing results this extreme if the null is true.

Looking Forward

Extending the GLM framework

Next Up:

- Part 4.2 | Bad Models

- Part 4.3 | Categorical Predictors

- Part 4.4 | Timeseries

- Part 4.5 | Causality

Later:

- Part 5.1 | Numerical Controls

- Part 5.2 | Categorical Controls

- Part 5.3 | Interactions

- Part 5.4 | Model Selection

> all built on the same statistical foundation